Special Report: Striking the right balance

As government help reduces, Colin Cottell looks at what now for recruiters

Short-term measures, such as cutting costs, are vital for recruiters to survive the effects of the Covid-19 pandemic on their businesses. However, it is equally important they plan for the bumps they will inevitably face further down the road, according to those who fund recruitment businesses and advise on their finances. At the same time, recruiters should keep in mind the saying ‘never waste a good crisis’, so they are ready to take advantage of the opportunities that will undoubtedly arise for those who are still standing when the pandemic finally comes to an end.

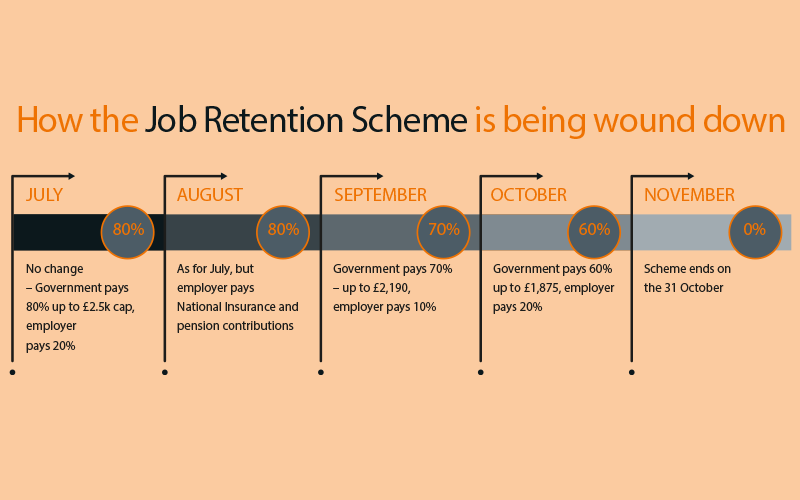

According to Miles Lloyd, CEO and founder of Milestones Consulting, one of the biggest bumps as the UK emerges from the worst of the health crisis will be the withdrawal – albeit in phases – of the government’s Coronavirus Job Retention Scheme (CJRS). Introduced by Chancellor Rishi Sunak to help employers avoid having to make mass redundancies, in June more than 9 million workers were receiving 80% of their pay up to £2.5k a month from the government. However, with the scheme costing £14bn a month, at the end of May Sunak announced that support for the scheme would be reduced in stages beginning in August, before ending completely at the end of October.

With nearly 65% of recruiters benefitting from the scheme, according to a Recruiter survey, Lloyd says the winding down of the furlough scheme “is quite clearly going to be a cliff-edge”. As he explains, the strain on recruiters’ own finances by having to pay their own staff will be exacerbated by clients deciding they cannot afford the cost of taking furloughed staff back on to their books. “The level of demand for labour in the UK is going to shrink very quickly and very significantly,” says Lloyd.

Mark Cardiff, partner, recruitment sector lead, at business advisory firm BDO, says he recognises the concerns around the withdrawal of the furlough scheme. However, he says the effects will not be uniformly felt across the sector. “All businesses are different in terms of where they are on the spectrum of wanting to keep teams together, with some owners accepting the pain of losses to keep the business going, through to those at the harder-nosed end who will look to move to redundancy quite quickly to preserve the whole.”

The level of demand for labour in the UK is going to shrink very significantly” Miles Lloyd CEO and founder of Milestones Consulting

Back into the fold

The decision to bring back staff who have been furloughed will depend primarily of the level of trading activity, Cardiff says, but also on the sector and the country in which they operate. “The US has been substantially less affected,” he says. Cardiff says recruiters are already asking themselves whether they want to invest in their balance sheet in bringing back staff when the company may be making a loss. “Some can do this, and some can’t,” he says. Rather than recruiters deciding to cut, say, 10% of staff across the board, he expects a great deal of trimming of under-performing teams.

The founder of a rec-to-rec firm, who wishes to remain anonymous, says he expects jobs to be slashed. “Recruiters will use this as an opportunity to focus on having 10 really high performers instead of 30 mediocre performers,” he warns.

Mark Lindsay, founder and director at WeDo Finance, says that even when recruiters do decide they can afford to bring back staff, they need to be aware of the lead time before they can contribute to the bottom line. “If they’re relying just on invoice finance, there could be a shortage of cash until the work builds up,” he adds. For this reason, Lindsay says his company has given loans to a couple of clients who are just bringing their staff back, which they will pay back over a number of months: “This will allow them to reintroduce the staff back in to take advantage of the opportunities and build the business back up.”

It’s finding the right balance between retaining your key staff, maybe investing in them now – which is going to cost a few quid – but on the other hand, because they are going to be loyal to you, you are going to be ready to go from day one” Stuart Hutchison, managing director of Recruitment Accountants

Chris Smith, partner, debt advisory at Clearwater International Corporate Finance, agrees that the unwinding of the furlough scheme “will be a key worry for a lot of recruitment businesses”. It will be of particular concern for recruiters, who have long-term debt funding, either because they have made acquisitions or had a management buy-out, and who as a result are already under financial pressure. Although the government Coronavirus Business Interruption Loan Scheme (CBILS) has been helpful, it is not necessarily a panacea, Smith says. “It is debt at the end of the day, and you do have to pay it back, but it should at least allow them to keep going through the period of uncertainty until their underlying sector opens up again.”

However, the final quarter of the year, when the furlough scheme comes to an end, is likely to be crunch time for recruiters’ finances, Smith warns. “There’s going to be a wall towards the end of the year with a lot of banking covenants waived until then. A lot of lenders have said: ‘Just let things slide until then’, so many of these businesses coming out of furloughing are going to need working capital to get started again.”

Additional capital

For those recruiters who believe they may need additional working capital to keep going, Smith advises that they need to act now. “Don’t wait to have those conversations with lenders until September or October, because there’s going to be a lot of pressure on lenders and their capital, and you might find you are at the bottom of the list.” In addition to touching base with their existing lender, Smith suggest recruiters should also be talking to challenger banks which are also CBIL-accredited.

Alex Arnot, an adviser to more than 35 tech and talent businesses, says he is not so sure that the industry will face a cliff-edge as the furlough scheme is withdrawn. “It’s all about planning now. So, if people put in really robust, well-thought out plans with maybe different options for scenarios A, B and C, then I think they can ride this difficult wave over the next three months.”

Even if they don’t need it now, Arnot suggests that one way to ride the wave is to take advantage of the government’s loan schemes. “If there’s an opportunity to take on a loan, and where there are no interest payments for the first 12 months – which is obviously what the government has been offering – and if you can get those loans, there is no harm in getting it, put it into a different bank accounts and wait to see if you need it.”

Avoid using the money as much as possible, Arnot advises, and then use it “almost as a shot in the arm to help the company accelerate away when the market gets better”.

Stuart Hutchison, managing director of Recruitment Accountants, a division of UHY Hacker, says the inevitable collapse of recruitment business over the coming months – “I fear up to 20% of businesses,” he estimates – will provide opportunities for those companies that plan effectively for ‘the new normal’.

“There will be fewer recruitment agencies and more candidates in the market, so there will be a significant amount of marketshare to be had,” Hutchison says. “It’s finding the right balance between retaining your key staff, maybe investing in them now – which is going to cost a few quid – but on the other hand, because they are going to be loyal to you, you are going to be ready to go from day one.”

Advice from the experts

- Do regular cash forecasts

- Conserve cash by cutting costs and by cutting all but essential spending

- Collect the money you are owed promptly

- Do not stop paying suppliers: speak to them to explain your position

- Take advantage of the various schemes launched by the government to support businesses, and keep up to date by using government and official websites

- Keep in touch with your bank – let them know of any problems before they arise

- Ask yourself whether there is enough business to justify the additional overheads when considering bringing back staff from furlough

- Consider taking staff back part-time at first

- Plan for the withdrawal and eventual ending of the furlough scheme

- Taking on a loan may save the business in the short term. But remember, at some stage it will have to be repaid

- Shop around for the best deals on invoice discount and invoice-factoring finance

- If you can’t get the credit insurance you need, look for an alternative supplier. If you still can’t get it, ask your funder if they will provide funding without it

- Keep on top of your debtors, and make sure that your debt doesn’t go over 120 days, which could put funding from your invoice finance or invoice factoring provider at risk

- Sadly, some recruiters are likely to go out of business. Look for opportunities to grow marketshare.