Tech-ing over the recruitment industry

Technology continues to grow the HOT 100, but an impressive year was had by all entrants.

It was another strong year for many in the UK recruitment sector. Despite ongoing global macroeconomic and geopolitical uncertainty, the sector’s resilience and buoyancy was once again evidenced. Acute skills shortages, candidate scarcity and changing working styles continued to drive growth across the sector amid the backdrop of a flight to technological innovation and increased market fragmentation, which appears likely to continue throughout 2024 and beyond.

This edition of the Recruiter HOT 100 shines a spotlight on recruiters that have successfully navigated the highly dynamic market in 2023, exhibiting sustained growth and prosperity despite a slowdown across the wider economy. This year’s list includes 72 new entries, many of which are upcoming recruiters that have outpaced their larger, more seasoned peers, which will continue to make a significant impact to the sub-sectors within which they operate throughout 2024. The sector’s resilience and heightened demand was evidenced by the significant year-on-year revenue growth for the companies listed of 20.7% to £6.2bn, which augurs well for the medium-term prospect for the sector.

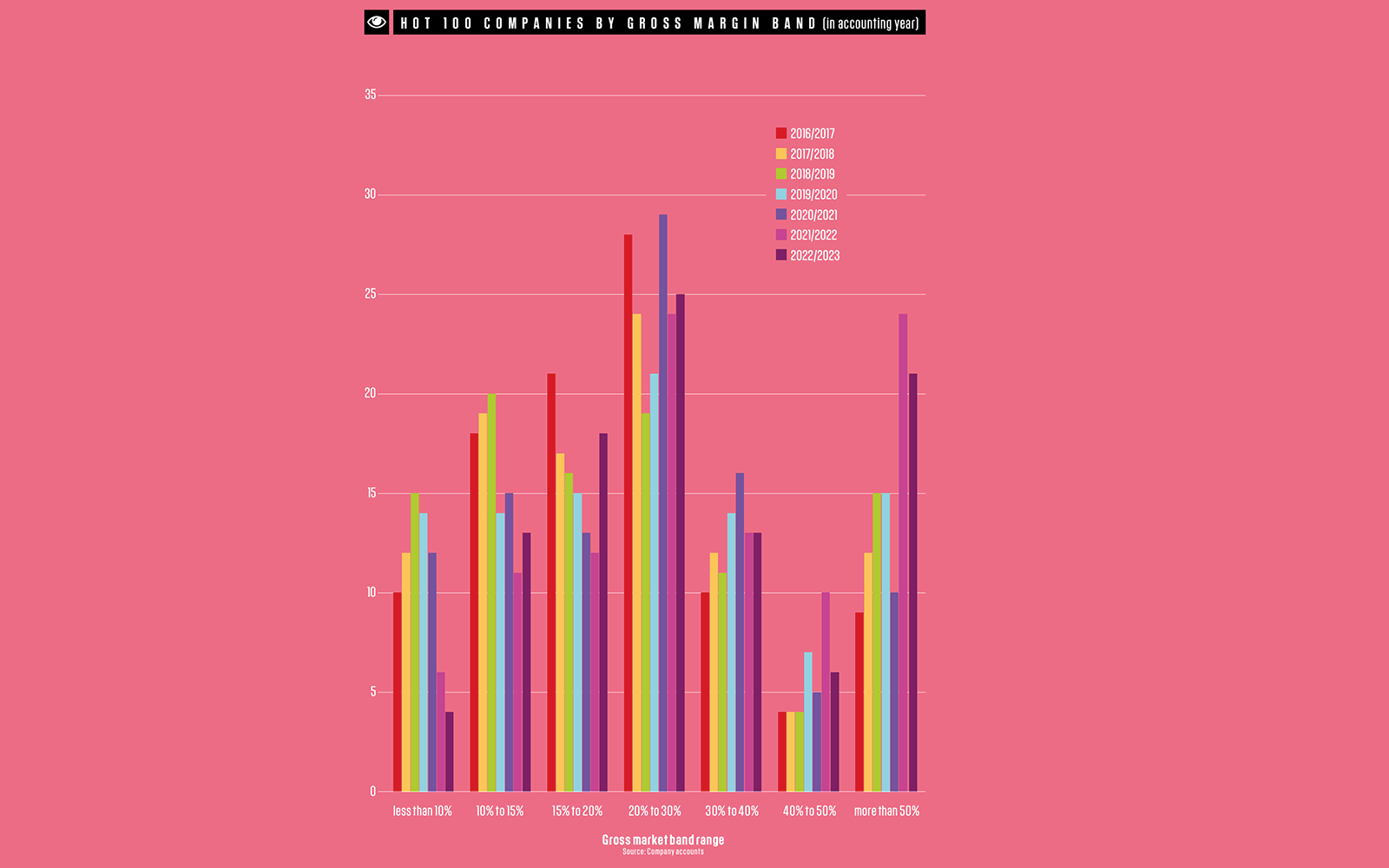

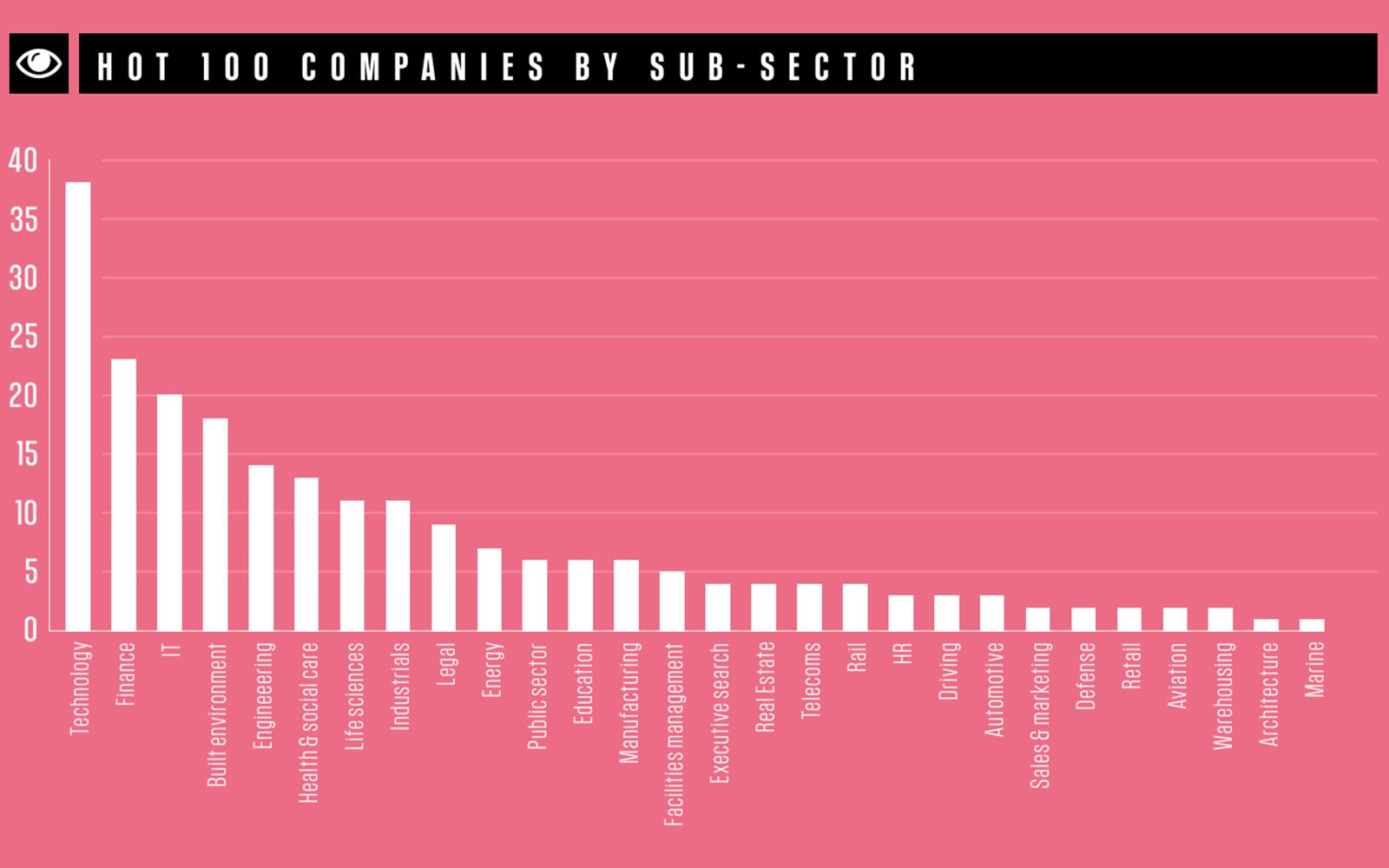

The technology sector’s dominance in this year’s list has been a recurring theme for several years, reinforcing the sector’s growth and resilience amid the backdrop of increasing digitisation and the importance of robust IT infrastructures and technical innovation in the post-pandemic environment. Technology sector recruiters have experienced significant enhancement in placement fees in recent periods, boosted by the impact of acute skills shortages in the sector driving blue-chip technology companies to pay premium fees for available talent.

Prominent sectors this year include education, IT, and health and social care, all of which are traditionally resilient to wider market cyclicality. Institutional investment within the sector remains targeted on companies with clear sub-sector specialisms, particularly within high growth, defensive markets, demonstrated by the 14 private equity-backed companies placed in this year’s list. PE-backed companies achieved an average gross profit (GP) per employee of £134,083, 4.5% higher than the £128,320 generated by their non-PE-backed counterparts. As PE activity becomes increasingly more prominent within the recruitment sector, the tangible impacts of PE are increasingly evident and can be attributed to four key factors:

- Increased levels of funding to be deployed into acquisitions, geographic expansion and technological advancements.

- A heightened focus on operational efficiencies and key performance indicators (KPIs).

- Access to a plethora of expertise and strategic advice.

- Potential synergies that can be gained from partnerships with a PE investor’s other investments.

Despite the challenges faced across more cyclical sectors in recent periods, the presence of built environment sector recruiters in the list has doubled in 2023, up from nine to 18 in 2022. This highlights a gradual softening in macroeconomic uncertainty that has persisted since the pandemic, a trend that is likely to continue as inflation falls and debt markets begin to ‘open up’, with a reduction in the cost of capital encouraging further investment and employment.

The growth and efficiency gains are increasingly evident across the sector as the average GP per employee increased year-on-year by 1.9% to £129,127, despite significant growth in the total number of employees across all companies in the list from 9,735 in 2022 to 11,713 in 2023. Growth in the average number of employees reflects confidence in the future of the UK recruitment sector, as recruiters continue to invest in talented fee earners to navigate the market through one of its most dynamic and challenging periods.

Gambit Corporate Finance

Established in 1992, Gambit is an independent corporate finance advisory firm specialising in advising private and public companies on mid-market transactions in the UK and overseas. With offices in London and Cardiff, Gambit is widely recognised as a market leader in M&A advice in the human capital sector, having built up detailed industry knowledge and an enviable track record in deal origination and execution.

Gambit’s dedicated human capital team has deep relationships with investors, vendors and acquirers in the sector and has significant M&A market experience across acquisitions, disposals, management buy-outs, fundraisings and restructurings.

Gambit operates both in the UK and internationally as part of Corporate Finance International, a global partnership of leading independent investment banks and corporate finance practices in 18 countries, which is ranked 17th in Europe for transactions under €200m (£171m).

Gambit’s recent human capital M&A experience includes the sale of Astutis Ltd to Wilmington Plc and the acquisition of BMSL Group by Indigo Group.

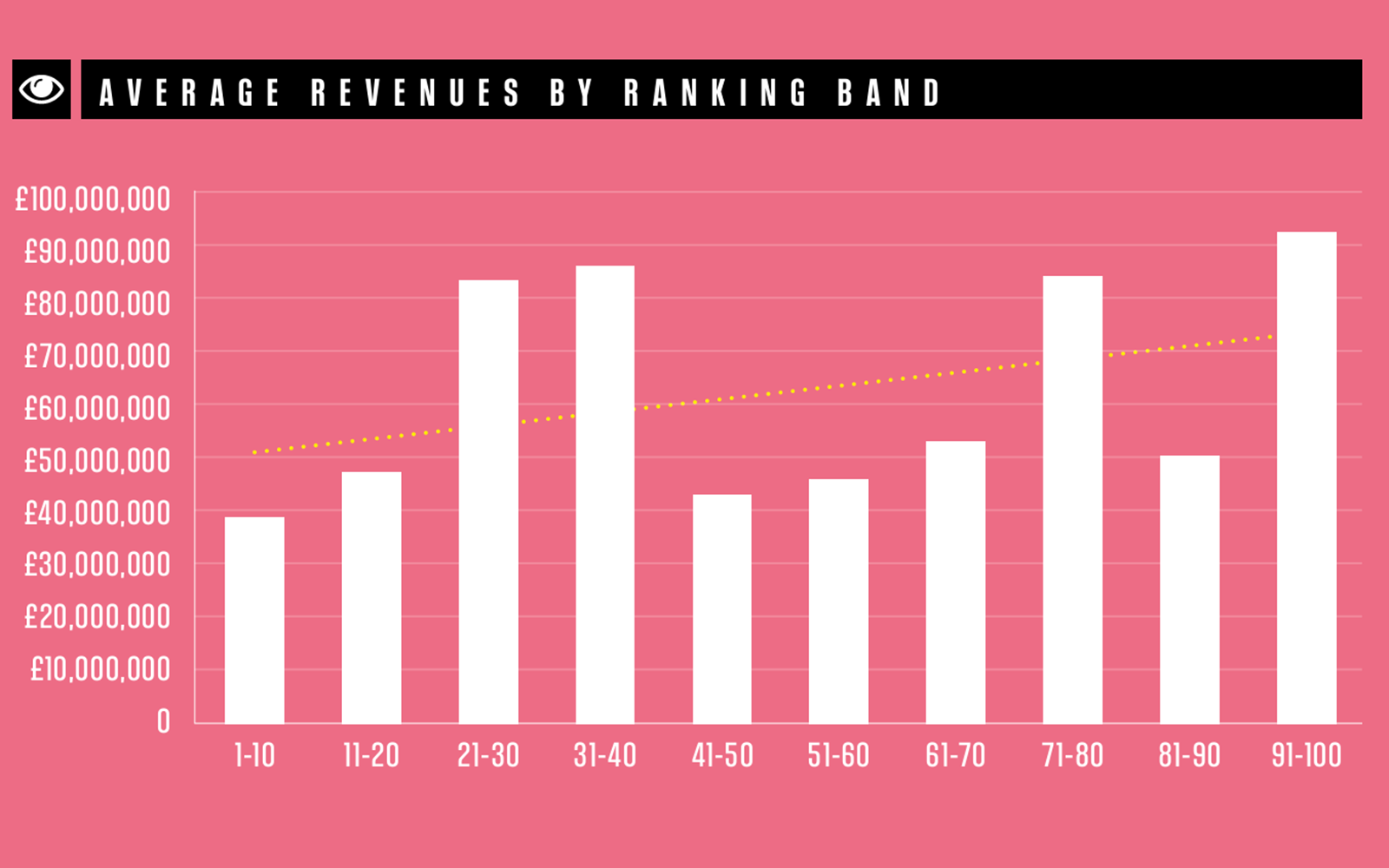

Size and Productivity

A continuing trend evident in this year’s list is the outperformance of mid-market recruiters relative to their larger peers, with the top 10 having revenues 39% lower than the average of all companies listed in the HOT 100. The success of mid-market recruiters at creating a more efficient, profitable business with lower revenues than larger players is being driven by four key factors:

- Heightened agility of smaller companies, enabling them to swiftly adapt to emerging market trends and legislative changes.

- A more scrupulous focus on internal KPIs and fee earner efficiency, helped by smaller, more focused teams.

- Increased levels of innovation and technology driven strategies often underutilised by large recruiters.

- Increased focus on specific geographic regions and attention on specific sub-sector specialisms as opposed to larger peers’ more generalist approach.

This disparity is also evident in employee numbers. Companies that ranked in the top 10 for GP per employee had, on average, the lowest number of employees, with an average of only 52, significantly lower than the average of 117 across the HOT 100. In contrast, firms in the 91-100 bracket had the highest average number of employees, at 186.

Notable mentions

- People Source Consulting has once again demonstrated exceptional performance by securing the number one position in the list for a third consecutive year, despite a 13.4% decline in revenues relative to the previous year.

- SR2 Rec has outpaced competitors with the highest percentage increase in both revenue and GP, due to its small, highly competent team, involvement in overseas recruitment and its specialism within the technology sector.

- Europa Search has led the way in team expansion, delivering the highest annual growth in employee numbers of 266.7%, earning the company a place on the list despite this being the first year that the company has been eligible to enter.

Key findings

- The success of the recruiters featured in this year’s list is illustrated by the total revenue of the HOT 100 recruiters reaching £6.2bn, a 20.7% increase from the previous year, highlighting the sector’s adaptability and resilience amid economic volatility.

- Technology continued to be the most prominent sub-sector specialism in the list, with 38 technology recruiters featuring, highlighting the sector’s growth and the increased digitisation of the global marketplace.

- Despite the sector’s significant growth in 2023, the minimum GP per employee required to feature in the list has fallen by 63.4% to £42,130, highlighting the continued competitiveness of the sector and the pressure on margins.

- The list exhibits a larger proportion of temporary recruiters, with a 55.3% to 44.7% split in favour of temporary over permanent placements across all companies. However, recruiters servicing the permanent recruitment market were more prevalent among the top-ranked companies.

- Some 14 companies are PE-backed, generating an average GP per employee of £134,083, compared to £128,320 for non-backed firms, illustrating the benefits of PE investment instilling a rigorous focus on growth in productivity and improving key performance indicators.

2023 key trends & outlook for 2024

A continuing trend in this year’s HOT 100 list is the superior performance of recruiters servicing high-growth, candidate-short sub-sectors, including technology, finance and IT. Technology continues to be the most prevalent recruitment sub-sector, with 38 of the HOT 100 companies operating in the sector. With increasing digitisation, the importance of robust IT infrastructures and the rapid advancement of technological innovations, we expect the sector to feature prominently in future years.

The outlook for the recruitment sector in 2024 is shaping up to be one of optimism, underpinned by a focus on agility and talent acquisition. Recent sustained reductions in inflation combined with an expected gradual reduction in interest rates from mid-2024 onwards will create stability, increase confidence and drive investment and hiring in the sector.

A continued adoption of flexible working is set to further evolve recruitment practices, widening talent pools and requiring changes in candidate engagement and company culture. A note of caution around a potential change in government in Q4 2024 and subsequent changes to tax and employment policies means recruiters must remain vigilant and prepared to adapt to the ever-changing market in the UK and beyond.

We would like to congratulate all those that made this year’s Recruiter HOT 100 and we look forward to receiving another batch of high-quality entries for the 2024 list later this year.

PDF OF THE RECRUITER HOT 100 COMPANIES 2023

Image credit | Getty