Special Report - The right set-up for your start-up?

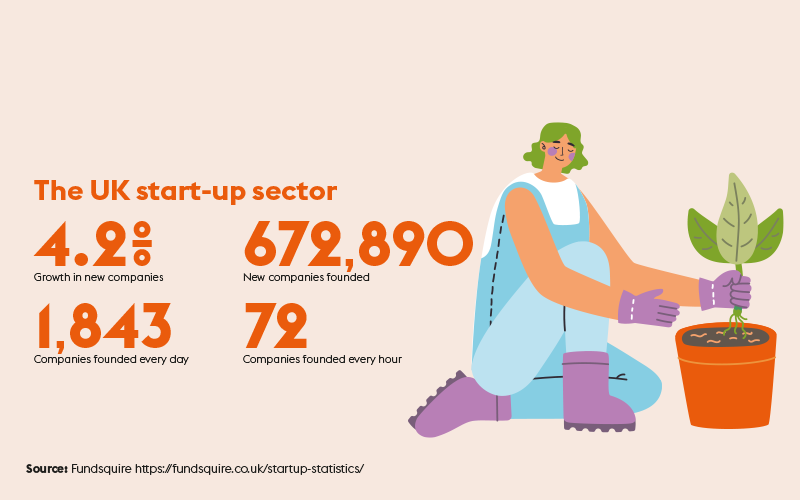

It may be a good time to go it alone, but to be successful means putting in the legwork first, say the experts

Start-up founders typically have one thing on their minds: securing their first deal. And after that it’s the next deal and the next deal… Of course, getting business in and cash flowing is critically important but as a business owner, you are also responsible for the nuts and bolts of business operations – tax, legalities, compliance, funding and more.

Recruiters need to adopt a totally new mindset and approach to work when they strike out on their own. Helen Phillips, director at The Contract Doctor, an organisation that provides legal, compliance and back-office services to recruitment agencies and staffing agencies, says: “You’re not a recruiter anymore, you are a business owner… The biggest thing people need to learn when setting up a company is mindset as there are a lot more obligations than just earning money.”

Top tips for new business owners

Neil Denniss:

- Think through your business plan carefully and not with rose-tinted spectacles

- Put contingency plans in place so that you don’t run out of cash

- Take suitable advice at the right time

Get the right structure

Start by identifying the best way to structure your company. Is it as a sole trader or as a limited company? What’s corporation tax and will you be liable further down the line? Will you be VAT registered or not? And so on. It’s important that the financials are sorted before you set up the company and register the name even, so that you trade on terms that will work best for you now and in the future. Leave it until the tills have started ringing, and you may regret it.

For example, if you set the business up correctly, there’s the potential to take advantage of tax-efficient investment options, such as Seed Enterprise Investment Scheme or the Enterprise Investment Scheme (see column, right). It can be harder to draw on these schemes once you’ve started trading.

A classic mistake that new business owners often make, according to Phillips, is setting their share value at a meaningless figure. “I spoke to someone who had incorporated their company with a million shares valued at £100 each. A lot of people don’t even know what a nominal share is – they don’t think about it. You ask people how they come up with the figure they have come up with and they say, ‘Because it sounds good’.”

Although share values can be adjusted later, it does take a bit of work and the tax office may start sniffing around if there are unexplained irregularities. This kind of situation can be avoided by getting the financial set-up right at the very beginning.

Get the right advice

Yet not all business founders seek professional advice before starting out. Phillips says a surprisingly high number of recruitment start-ups ignore the basics and launch themselves straight in. “A lot of people bury their heads in the sand,” she says. “Many aren’t interested in it, and don’t realise it’s important – they think it’s only admin and it doesn’t mean anything. They only come to us after something has gone horrifically wrong.”

All indices suggest that now is a good time for recruiters who want to go it alone to make their move. But as Neil Denniss, a founding partner of Bespoke Tax Accountants, says, it only works if people put in the legwork to understand what it means to run a business on a practical level.

“There’s going to be an awful lot of people setting up a business who are going to have to be ‘Jack of all trades’ in areas they haven’t been trained in, who don’t understand how a company works, how a sole trader works… You are learning all this on the job and experience can be useful, but it can also be expensive if it goes wrong,” says Denniss.

Like Phillips, Denniss advises that new business owners take professional advice early on. But in his experience, finances are often tight for start-up professionals, leading many to cut costs where they can. They either decide to manage tax and the other financials themselves or they put off sorting it out until the money is coming in. “They make a cost analysis rather than a value analysis,” he says. “And like anything in life, if you buy the cheapest or cut costs, it either saves you money or ends up being very expensive for you.”

Top tips for new business owners

Helen Phillips:

- Realise that nothing happens overnight with back-office processes

- Planning is essential – don’t wait for a deal to get your processes in place

- Don’t set yourself up for failure – get the basics in place

- Know every area of your business and what other people do in case that person leaves or is ill and you must do their job

Get the right agreement

One problem that Denniss sees time and time again is two or more business partners setting up without formalising how they intend to do business or how they will deal with various scenarios that could arise further down the line.

Partners need to draw up a shareholders’ agreement when they set up the business so that differences and disputes can be resolved easily, Denniss says: “It’s what I call the birth, the life and the death of the business – the foundations of the business, what happens if someone wants to sell out… You need to cover all of this in the shareholder’s agreement so that everyone has a good feel for the rules of the game and people play by the rules. And if they don’t play by the rules, then you have the rules book to refer to.”

When shareholders disagree about how to run a business or the direction it needs to take, it can cause ruptures that are impossible to heal. It can be terminal for a business. And if a shareholder’s agreement isn’t in place and the business partners can’t resolve the situation amicably and fairly themselves, then Denniss says it typically ends in the law courts. “The fallout is like a divorce. There’s a lot of acrimony, fairness doesn’t necessarily prevail, and it’s the lawyers who win.”

On the horizon, Denniss predicts, is a change to when assessments are made for tax. Currently, everything happens at year end, but because of Covid-19, the government is now keen to get real-time information on business finances. “I think we will get to the point of monthly tax bills, based on real-time information,” says Denniss. “We know it’s in the wind, and I can see it happening in three to five years’ time.”

Tax relief for start-ups

The Seed Enterprise Investment Scheme (SEIS) targets investment for early-stage companies – those with less than two years of trading history and 25 employees. Individual investors – no companies – can invest up to £100k in a SEIS business per tax year. SEIS companies can accept no more than £150k SEIS funding total.

SEIS is not a source of venture capital; it is an incentive offering. The government does not provide cash. Instead SEIS provides tax relief to investors who buy shares in qualifying businesses. The intention is for companies to find it easier to attract the investment they need.

There are three tax reliefs available under SEIS, each requiring that the investor is an individual who is UK tax resident.

The three reliefs are:

Income tax relief: Limited to £50k (£100k at 50%) per investor. The income tax can be claimed in either the tax year in which the investment was made or the preceding tax year.

Capital Gains Tax exemption sale of SEIS shares: Any increase in value of the SEIS shares is exempted from Capital Gains Tax so long as the shares qualified for and retained their income tax relief for at least three years.

Capital Gains Tax relief on other disposals: The capital gains on disposals of other assets can be partly exempted from CGT where the gain is matched with a SEIS investment in the same year. A maximum of 50% of the SEIS investment can be matched with a relevant gain. For example, an investment of £25k can be matched with a capital gain of £12.5k in the same tax year in which the income tax relief is claimed.

Among the many conditions to be met by the company is it must be an unquoted trading company and the company’s gross asset value cannot be more than £200k before the share issue.

Sources: Financial information company Swoop and Bespoke Tax Accountants

Image credit | Shutterstock