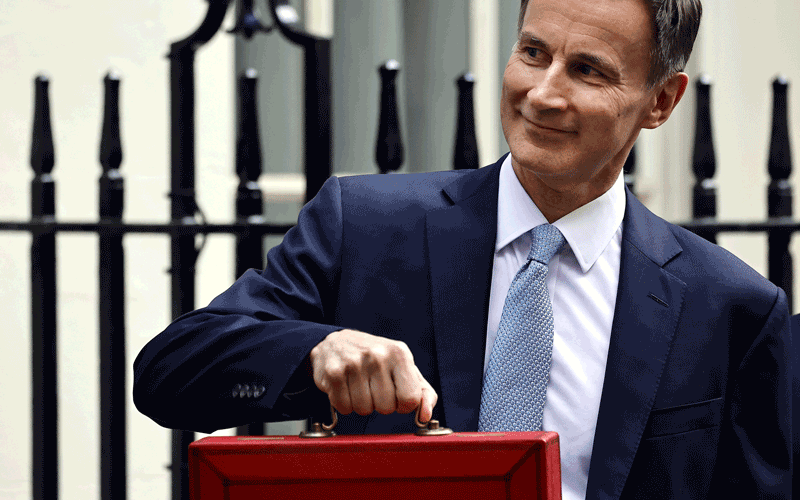

Spring Budget: Lukewarm response from recruitment industry

Chancellor Jeremy Hunt’s Spring Budget has received a lukewarm response from recruitment bodies and others with interests in the sector.

There was significant disappointment expressed about the limited attention paid in the document to skills measures and workforce that “didn’t add up to the industrial and workforce strategy we really need”.

Neil Carberry, CEO of the Recruitment & Employment Confederation (REC), opined: “It beggars belief that the Chancellor made GDP [gross domestic product] per capita, driven by the domestic workforce, a core goal of his speech but had nothing to say about the skills system beyond a few specific pots of spending and pieces of devolution.

“There were many sensible steps,” Carberry acknowledged, including “from AI skills support in professional services, to growth support on finance for small businesses and a patchwork of sectoral measures.

“But taken together, they didn’t add up to the industrial and workforce strategy we really need.”

Tania Bowers, global public policy director at APSCo, said: “For the staffing sector, there were numerous elements missing that we had expected to see and very little on the workforce or skills. The Chancellor is continuing to rely on previously launched programmes to get the 10m adults of working age back into work plus the cuts to employee National Insurance. We think this will offer greater encouragement to the lower paid and lower skilled to enter work.

“In the skilled sectors, continued shortages will dampen the effect, with APSCo research showing applications per job across the life sciences sector down 54% month-on-month and 40% year-on-year in February 2024. In the IT sector, which is key to the success of the newly announced NHS Public Sector Productivity Plan, applications per job dropped 46% between January and February this year (jobs only fell by 7% in this time). They are also down 27% from the beginning of 2023.”

Bowers also rounded on the government for failing to address challenges around ensuring best use of the Apprenticeship Levy “to align with skills requirements, which does require greater government collaboration with businesses on regional skills hubs and training”.

Both Bowers and Carberry were wary of plans around measures to support the NHS and the launch of the NHS Public Sector Productivity Plan, with the £3.4bn to be invested in IT systems modernisation which, Bowers said, “will create many permanent and flexible nonclinical roles”.

“However,” she warned, “we hope there are the specialists in technology and AI in the labour market to deliver. We fear an overreliance on consultancies, which are generally far more expensive overall than the use of skilled flexible contractors through recruitment businesses.”

Carberry added: “Healthcare agencies keep the NHS open. But on-framework provision has been made unsustainable over the past few years by poor management and unrealistic cost assumptions. You can’t freeze wages for temporary nurses through a pandemic and inflation spike – but that is what this government tried to do, super-charging higher cost off-framework provision and hidden high-cost Bank provision.

“Hopefully,” Carberry said, “today [6 March 2024] is the start of a discussion where agencies can finally be allowed to help the NHS reduce cost and improve the standards of care – but that requires a true partnership. We are ready to help. The deadline the government has set for ending off-framework this summer is unrealistic and would likely damage the quality of care and increase waiting lists.”

Commenting on the Budget, Chris Bryce, CEO of FCSA, said his organisation “particularly welcomes the announcement in paragraph 5.42 of the Red Book regarding tackling non-compliance in the umbrella market; it’s good to see that the umbrella regulation we’ve long called for is still high on the government agenda. However, we’re disappointed that yet again the Chancellor didn’t take this opportunity to address the widely-criticised off-payroll working rules or IR35”.

The Red Book is the web version of the Budget. In the paragraph Bryce references, the government says it is “committed to protecting workers employed by umbrella companies… and preventing significant Exchequer losses caused by tax non-compliance”. It goes on to say: “The government will provide an update on the recent consultation on tackling non-compliance in the Spring Budget 2024 umbrella company market at Tax Administration and Maintenance Day. In summer 2024 the government will also publish new guidance to support workers and other businesses who use umbrella companies.”

Bryce added: “The much-briefed 2 percentage point reduction in Employees’ National Insurance (EeNICs) and the self-employed equivalent is clearly going to be welcomed by many and is clearly targeted with a focus on workers rather than providing reductions to all taxpayers as a simple reduction in income tax would have done. This will also hopefully reduce the temptation of schemes and scams offered to umbrella workers. However, it’s not necessarily all good news for LtdCo contractors, as EeNiCs is largely paid by those who are in employment, and of course it only applies to those who are paid over the NICs threshold of £1,048 per month.”

Seb Maley, CEO of Qdos, an insurance provider to the self-employed, was also critical of the Spring Budget and pointed out its lack of attention on the IR35 legislation, a key issue for self-employed and contractors: “The Chancellor’s decision to reduce National Insurance… may save employees £450 a year and sole traders £350 a year but sees millions of other small business owners slip through the cracks.”

Maley went on to say: “For all the talk about long-term growth, the government has overlooked those key to achieving this. With an election looming, this Budget won’t have convinced millions of self-employed workers that this government has their best interests at heart.”

He said yesterday’s budget meant the Chancellor had failed to deliver on the most important issues facing freelancers and contractors. A survey of over 900 of these workers undertaken by Qdos found that:

- Over two-thirds wanted the government to scrap the off-payroll working rules (IR35 reform)

- A fifth wanted the government to reverse the recent Corporation Tax increase

The survey also found, Maley said, that almost two-thirds of the self-employed do not believe that any major political party represents their best interests. In contrast, just 11.1% believed the Conservative party did.

• Comment below on this story. Or let us know what you think by emailing us at [email protected] or tweet us to tell us your thoughts or share this story with a friend.