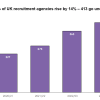

Fast 50 firms flying high up the charts

Compared with other commercial sectors, the UK recruitment sector has always produced an exceptionally high number of fast growing businesses. Among other factors, this is explained by recruitment’s strong culture of entrepreneurship, the use of scalable business models and the UK’s flexible labour laws. The 2009 Recruiter/Catalyst Fast 50 league seeks to identify the sector’s most successful players based on recent growth and to provide background on their success.

With 2009 being the inaugural year for the Fast 50 list, this year will no doubt prove even more testing than the previous year, and really sift out the ‘quality wheat from the chaff’.

The methodology for inclusion is given below and a brief overview of growth in various sectors is also analysed, along with the impact of other factors, such as sector, geography, revenues and private equity.

Growth by sector

Just over half the companies (52%) featuring in the Fast 50 serve more than one sector, which highlights the merits in diversification and the benefits of crossselling across client bases. Sectors served by these ‘multi-sector’ players in the Fast 50 tend to focus on Professional Services, Clerical & Secretarial, IT & Telecoms, Financial Services and Engineering & Technical.

The remaining 48% are essentially niche players, serving a single sector with which they have developed a close association, understanding and brand recognition. In particular, niche players in the Fast 50 which serve the Engineering & Technical (14%) and IT & Telecoms (14%) sectors have a strong showing.

In recent years, the growth of many Engineering & Technical players has been driven by international energy exploration activities and capital investment projects on the back of record oil prices. IT & Telecoms players have also prospered during the pre-credit crunch bull markets, particularly those serving the Banking & Financial Services industries. Inevitably, the outlook for many of these specialist recruiters is now more challenging in light of the recessionary economic conditions facing the banking, financial service, oil and gas, and engineering clients.

Elsewhere, some specialist construction recruitment firms, representing only 4% of the Fast 50, have grown strongly on the back of the UK residential and commercial property booms. Such players face particularly challenging times as projects are being put on hold due to a lack of debt funding and the downturn in demand for property.

Revenue

The Fast 50 is dominated by players with revenues in the £10-50m range (56%), while only 14% have revenues in excess of £50m. The low representation of the £50m+ revenue category is most probably explained by the natural effect of relative growth becoming increasingly difficult to achieve once a business has a high level of sales.

Another factor is likely to be the change in ownership structure which often takes place in businesses with sales over £50m when they are acquired by larger players or floated on public markets. The Fast 50 only includes private companies and therefore excludes businesses which have been acquired or floated.

Growth — organic versus acquisition

Overall, the Fast 50 members have achieved their exceptional growth organically rather than by acquisition. In our direct experience, private owners can be reluctant to engage in merger and acquisition (M&A) activity — understandable given the risks and costs associated with completing transactions and successful integration. Instead, private owners of the Fast 50 members, as we would expect, have achieved success by focusing on their own businesses and organic growth.

Only seven Fast 50 companies have made acquisitions over the last three years, which have supplemented growth. The average compound annual growth rate (CAGR) of those businesses which have engaged in M&A is 63.8%, while the average for those which have not is 50.5% CAGR. This demonstrates that overall growth by acquisition has not had a major impact on growth rates, although the hidden benefits of acquisitions are often significant. These benefits include lowering business risk by diversifying into new sectors or gaining quick access to attractive overseas markets. Details of the Fast 50’s acquirers are below:

- 3rd FiveTen Group: five acquisitions including overseas (Russia and Australia)

- 5th First People Solutions: two acquisitions of UK Oil & Gas recruiters

- 11th Rise Group: one domestic acquisition

- 42nd Xchangeteam: two acquisitions of marketing/creative recruiters

- 44th Beaver Management Services: one £13m acquisition

- 45th Jark: two acquisitions of UK non-professional recruiters

Geography

Beyond an expected weighting towards London and the South-East, there is little trend or bias in the UK locations of Fast 50 members, with players represented in all regions of England, Scotland, Wales and Northern Ireland.

Only 16 of the Fast 50 members have established offices overseas, although many place candidates overseas through their UK operations. The average revenue of businesses with overseas offices is £28m with an average CAGR of 54.5%. This exceeds only marginally the average revenue of businesses with UKonly offices of £25m and an average CAGR of 51.9%. The lack of material difference here may be explained by the fact that overseas growth is often slow in the early stages due to the burdens of setting up operations in new legal and commercial jurisdictions. However, these delays are often followed by higher levels of growth later on. Therefore over a longer term, higher growth rates would be expected for players which have successfully expanded overseas.

Private Equity

Ten members of the Fast 50 are backed by private equity investors who own between 10% and 65% of equity in those Fast 50 companies. Furthermore, eight of these companies are in our top 25, which is unsurprising given that high growth rates are required to attract private equity investors. Inevitably, these businesses have higher levels of debt than the other privately-owned Fast 50 businesses, although many have repaid sizeable amounts of their debt from cash-flow achieved during the profitable years of 2006, 2007 and early 2008.

The Fast 50 private equity-backed businesses are:

- 1st Mentor (Iceni)

- 3rd FiveTen Group (Englefield)

- 6th GRS (Penta)

- 7th Huntress (Nomura)

- 11th Rise Group (Murray Capital)

- 13th Eden Brown (Hamilton Bradshaw)

- 18th Aston Carter (Baird)

- 23rd Astbury Marsden (Northern Venture Managers)

- 32nd Driver Hire (Aberdeen Murray Johnstone)

- 41st Red Commerce (Inflexion)

Despite the current low availability of funding, which is needed by private equity to complete acquisitions, it is likely that private equity deals will continue in the recruitment sector, albeit at a reduced rate in the short term. In the medium term, private equity is expected to return to invest, attracted by recruitment’s impressive growth rates, cash generation and the overseas growth opportunities.

2009 and beyond

Market conditions in the second half of 2008 challenged many recruitment players in the UK, including some of the strongest players who are represented in the Fast 50. Furthermore, 2009 is already shaping up to present an even more testing environment. Indeed a number of recruitment’s weaker businesses have already gone into administration, and many more will inevitably follow.

Players most likely to ‘weather the storm’, and we hope will continue to grow, are those which have previously taken care to develop their client and candidates bases, who have invested time and money in their databases and other IT systems, and who have recruited, developed and motivated a professional employee base. Additionally, the presence of footholds in overseas territories where economic growth remains resilient in spite of the global slowdown may also prove valuable to growth. It is perhaps no coincidence that many players with these growth characteristics feature on the Fast 50.

Tim Evans is a director and Mark Kingston is a senior analyst at Catalyst Corporate Finance, an independent M&A advisory house, advising on deals with values between £10m and £100m

Methodology

The Recruiter/Catalyst Corporate Finance 2009 Fast 50 ranks the fastest growing private recruitment businesses in the UK by sales.

Criteria for inclusion: The Fast 50 assesses temporary and/or permanent recruitment companies which are registered in the UK as private, independent and unquoted companies. This category includes private companies that are backed by private equity houses. All companies considered for inclusion in the Fast 50 achieved a level of annual sales of £5m or above in at least one of the three financial years assessed.

Exclusions: Companies which have filed abbreviated accounts at Companies House without disclosing sales levels are excluded. Unaudited management accounts are not accepted due to the absence of any third party validation. Companies that have any shares or other financial instruments listed on a stock exchange, or where any of their shares are held by any UK or overseas quoted company, do not qualify for inclusion.

Furthermore, businesses that serve the recruitment sector through the provision of IT, payroll, administrative or other services also do not quality.

Data-collection methods: Companies have been identified through several research methods including the analysis of information from Companies House, financial databases, press coverage and other research.

Any firm which believes that it may not automatically be included in the 2010 Fast 50 due to the unavailability of public statutory accounts information but which believes it has a verifiable case for inclusion is invited to contact Mark Kingston of Catalyst Corporate Finance. Email: [email protected].

Fast 50 firms share their success

Recruiter and Catalyst Corporate Finance have compiled a list of the 50 fastest growing recruitment agencies (click here for the full list). Julian May interviewed five representatives from the Fast 50 to discover the secrets behind their phenomenal growth

Chapman: niche areas are key

Faststream Recruitment

Sectors: Architectural, building design, maritime and shipping, oil & gas and mining.

Founded: 1999. Fast 50 place: 47

The global operations are run from Southampton with offices in the US (covering North and South America), Norway (Scandinavia) and Singapore (Asia Pacific).

Diversification has been key in its growth. Mark Charman, managing director, recently set up The Meeting House, an executive search and selection consultancy specialising in senior talent acquisition in the shipping, marine, energy and commodities markets.

He told Recruiter: “We identify niche areas that we understand and where we can provide a pure recruitment consultancy model.”

Charman said the firm has seen “fantastic year-on-year growth” but the focus is on net profitability rather than “unsustainable” high turn-over and low margin business models. “I very much adhere to the adage: ‘turnover is vanity, profit is sanity and cash is reality’.”

International recruitment, particularly developing specialisms within specialisms, has been marked for growth. There are plans for 10-15 new staff in 2009, mostly consultants in Singapore, which is “proving a massive growth area and seems immune to the global downturn”.

Aston Carter

Sectors: Permanent, contract and search, IT financial services.

Founded: 1997. Fast 50 place: 18

The business has diversified into consulting, HR, senior appointments and finance and operations, with offices in 16 European and Asian countries. Staff numbers have grown 26% to 252 since last year.

Chief executive Sean Zimdahl told Recruiter that the extensive in-house training programme and company share incentive scheme have helped to improve staff retention (average attrition is less than 12% since 1998).

There has been “significant pressure on UK contract margin” in the financial services sector.

“However, we are currently 10.4% ahead on a net fee income (NFI) level compared to the same period last year, profits are in line with expectations and with less than 45% of NFI coming from the financial services market, and more than 34% being generated internationally, we are well placed to make the most of any opportunities,” he explained.

Aston Carter’s growth plans continue with new offices opening in Berlin and Zurich and further client diversification in the UK.

Znowski: focus on Europe

Eurostaff Group

Sectors: Senior roles in technology and finance.

Founded: 2003. Fast 50 place: 14

Mark Znowski, director, and co-founder Paul Flynn decided to focus on Germany and the Benelux region from the firm’s London headquarters, rather than the “saturated” UK market.

The partners concentrated on high level project and programme managers on a contract basis with clients such as IBM and AXA, which were “high yield areas with placement fees of five figures”.

Eurostaff only employs the top graduates, training them to become leaders in their fields, said Znowski.

‘Warts and all’ honesty with staff has helped keep attrition low, and keeping hold of key staff has helped to grow the business. Eurostaff is also debt free — there is no venture capital.

The company is expanding in 2009, launching its Gulfstaff brand, focusing on the Middle East region, based in Abu Dhabi.

Eurostaff has also begun high-level engineering and HR recruitment in Europe and is setting up an office in Germany this year to be closer to its clientele.

“We hope to turn over about £20m this financial year. We aim to be one of the top international recruiters, by gross profit, in the next five years,” said Znowski.

Smith: significant growth

Investigo

Sectors: Project and change management professionals to the banking, financial services andcommercial sectors.

Founded: 2003. Fast 50 place: 10

Simon Smith, managing director, started Investigo with joint managing director Scott Beckson and six staff. They now have over 60 employees.

Investigo turned over £600,000 in year one, is estimating a £27m turnover this year and hopes to make £2m profit. “That is pretty significant growth considering we started the business with £90,000,” said Smith.

Smith said one reason for success was the staff equity scheme, where franchise partners invest in their own business unit in return for a stake in the company. The scheme has empowered staff, enhanced continuity of relationships with candidates and clients, and attracted top talent from the competition.

Investigo only employs experienced staff — most (95%) have a minimum of three to five years’ experience, meaning less spend on training and development.

Household name clients like Apple and Tesco have also helped to attract high quality candidates.

Investigo is planning “sensible expansion” in performing markets this year, said Smith.

Roberts: hire the right people

Drivers Direct Recruitment Agency

Sector: Driving. Founded: 2002.

Fast 50 place: 35

Gethin Roberts, managing director, opened the business with three branches, focusing on everything from chauffeurs to HGV, professional and coach drivers.

Staff have increased from 11 to 33 and 400-500 drivers are out every day, said Roberts. Despite the “tough and tightening” market since the downturn, trading has still been “reasonable”.

“I don’t have an expensive head office or the overheads that a top 50 company does. We will not be that far off last year’s profits [about £500,000],” Roberts said.

The key to Drivers Direct’s success is hiring people with the right attitude and professional understanding and a comprehension about what each employee is expected to make financially, said Roberts, an ex-transport worker himself.

“We are working on a big contract at the moment and are looking at opening offices in areas such as London, Sutton, Leeds and Reading. In the next 12 months there will be at least three new branches.”

Roberts has also taken advantage of government rules that come into force in 2009, which mean all professional drivers must be CPC qualified, by setting up a training division offering free NVQ qualifications.